(CNN) — More Americans with diabetes will get rebates on insulin costs in 2024.

Sanofi has joined the country’s two other major insulin makers in offering a price cap or savings program that reduces the cost of the drug to as little as $35 for many patients. The three drugmakers will also dramatically reduce the list prices of their products.

The measures were announced in the spring, but some did not take effect until January 1.

Drug manufacturers have been criticized for years for dramatically increasing the price of insulin, which is relatively cheap to produce. According to the American Diabetes Association, the inflation-adjusted cost of the drug increased 24% between 2017 and 2022, and spending on insulin tripled over the past decade to $22.3 billion in 2022.

According to the association, about 8.4 million Americans depend on insulin to survive, and 1 in 4 patients are unable to pay for their medications, causing them to ration doses, sometimes with fatal consequences. Are.

Congress and new market players have increased pressure on insulin manufacturers to reduce prices. People enrolled in Medicare no longer pay more than $35 a month for each of their insulin prescriptions, thanks to the Inflation Reduction Act, which Democratic lawmakers pushed through Congress in 2022.

But drugmakers also faced changes to the Medicaid reimbursement program, potentially losing millions of dollars each if they did not lower their list prices.

Price Range US$35

Sanofi has set a monthly limit on out-of-pocket costs for its most commonly prescribed insulin, Lantus, at $35 in the United States for all patients with commercial insurance as of January 1. It already sets the cost for all uninsured patients at $35.

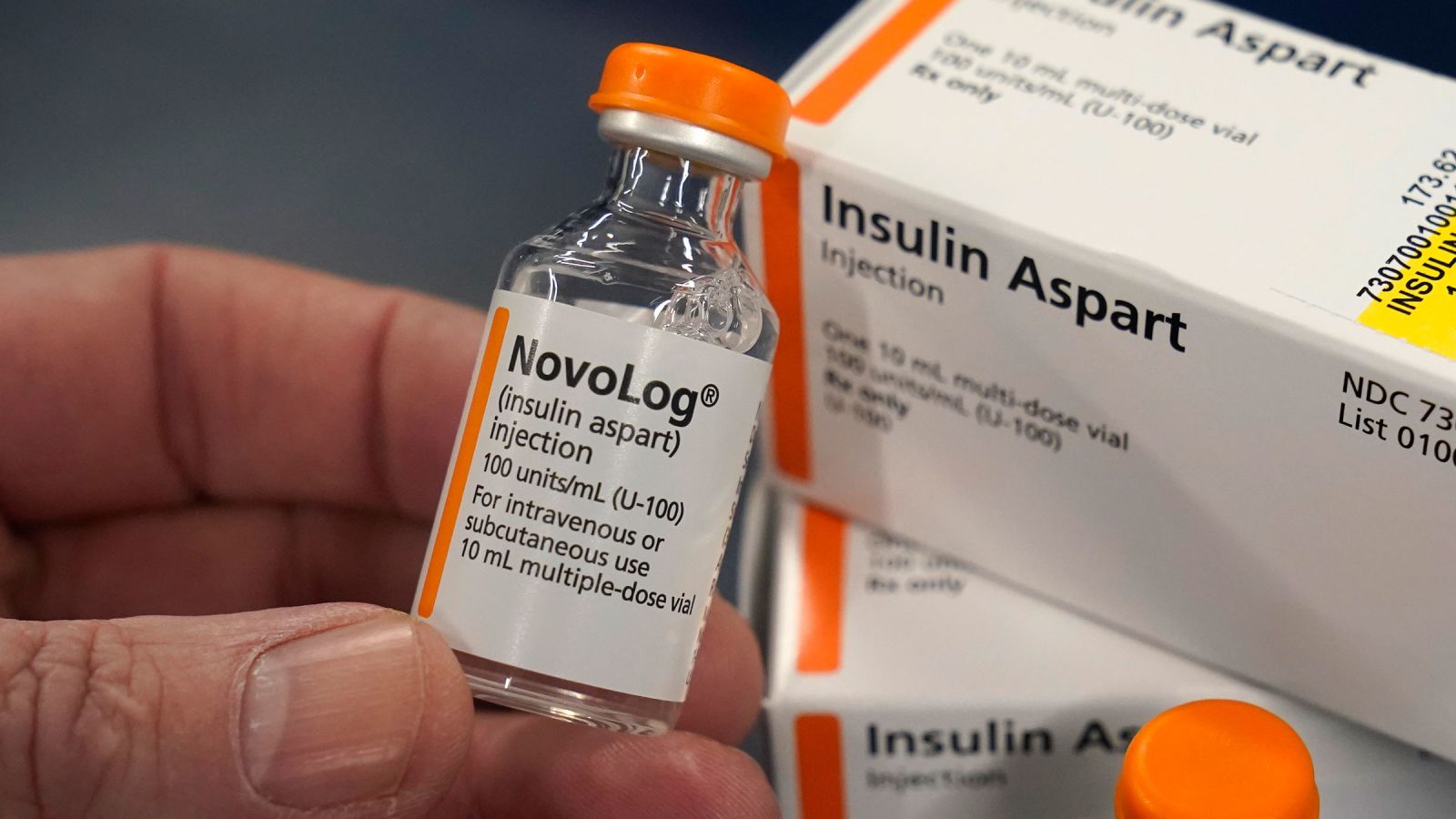

Novo Nordisk launched the MyInsulinRx program in September, providing a 30-day supply of insulin for $35 to eligible patients, including those without insurance. The company also offers a copay savings card that allows eligible patients to purchase their insulin products for as little as $35 and no more than $99, depending on their health insurance coverage.

In March, Eli Lilly established an automatic $35 monthly limit on out-of-pocket costs for people with commercial insurance who purchase its insulin products at participating retail pharmacies. People without insurance can download the Lilly Insulin Value Program savings card, which allows them to get the drug for $35 per month.

Tim Lash, president of the West Health Policy Center, said insulin makers are now more willing to limit out-of-pocket costs because of public pressure to increase affordability and new competitors like Civica RX. Cost of medical care. Civica RX manufactures and sells insulin for more than US$30 per vial.

These limitations will also help the three companies strengthen their relationships with their patients.

“The amount of profit they can give up by capping costs is relatively limited,” Lash said. “The goodwill they get is very important.”

Saving millions in Medicaid reimbursements.

The three companies will also reduce the list prices of many of their insulin products, something lawmakers and patient advocates have been pushing for for years.

Sanofi reduced the list price of Lantus by 78% from January 1, to US$96 for a prefilled pen and US$64 for a 10 ml vial. It also reduced the list price of its short-acting insulin Apidra by 70%.

Novo Nordisk reduced the list prices of many of its insulin vials and prefilled pens by up to 75%, including Novolog, Novolin and Levemir, effective January 1. The new list price for NovoLog is US$72 per vial and US$140 for the FlexPen.

Eli Lilly said it would reduce the list prices of Humulin, its most prescribed insulins, and Humulin by 70% by the end of 2023. Our list price will now be $66 per vial.

Experts say these measures are carefully timed and will save companies millions of dollars per year. That’s because the American Rescue Plan Act of 2021 made a major change in the rebates that drugmakers pay annually to state Medicaid programs, a change that took effect Jan. 1.

Reimbursement is based on how much a drug’s list price has increased relative to inflation and how much it is discounted in the commercial market. Until now, that discount was capped at 100% of the drug’s manufacturer’s average price, which is an indicator of its list price.

But that limit disappeared on Jan. 1, so rebates can now exceed the amount the drugmaker earns from Medicaid for the drug. According to analytics and research company IQVIA, about 15% to 20% of brand-name drugs have reached their limits.

By lowering the list prices of Humalog and Humulin, Eli Lilly could avoid paying an additional $430 million in Medicaid rebates in 2024, said Spencer Pearlman, director of health care research at Veda Partners, a consulting group that provides analysis of institutional policies. Does. Investor. Additionally, because of the way the reimbursement formula is designed, Eli Lilly could earn an additional $85 million in Medicaid profits.

Novo Nordisk could avoid about $350 million in new refunds and make about $210 million more on Novolog and Levemir. Meanwhile, Sanofi could avoid $560 million in refunds and make an additional $200 million in profits from Lantus.

When asked for comment on the Medicaid reimbursement payments, Novo Nordisk said the price changes trigger multiple operational needs and impact multiple parts of the business, which is why it implemented them on Jan. 1.

Sanofi said it is reviewing its pricing and access strategies to balance affordability for patients and allow the company to continue investing in innovation.

Eli Lilly responded that it considered a number of factors, including changes in the market, laws and regulations, to determine the appropriate time to reduce list prices in a way that is affordable for patients and ensures That the company can continue to operate a sustainable insulin business. Which can continue to provide the drug at low or no cost to Medicaid.

Drug manufacturers may have suffered huge losses as they all raised the list prices of their insulins and offered huge discounts to pharmacy benefit managers to ensure that their products were covered by insurance plans.

“Prior to the price cuts, these older insulin products were dramatically more expensive from a pricing standpoint than they were 30 years ago, when they were first released, and they were heavily discounted,” Perlman said. “