© Reuters.

Investing.com – The session starts this Thursday, February 29, with the US Dollar showing modest gains ahead of the Federal Reserve’s (Fed) preferred inflation data for January. This information will be important in adjusting expectations about the future of interest rates in the United States.

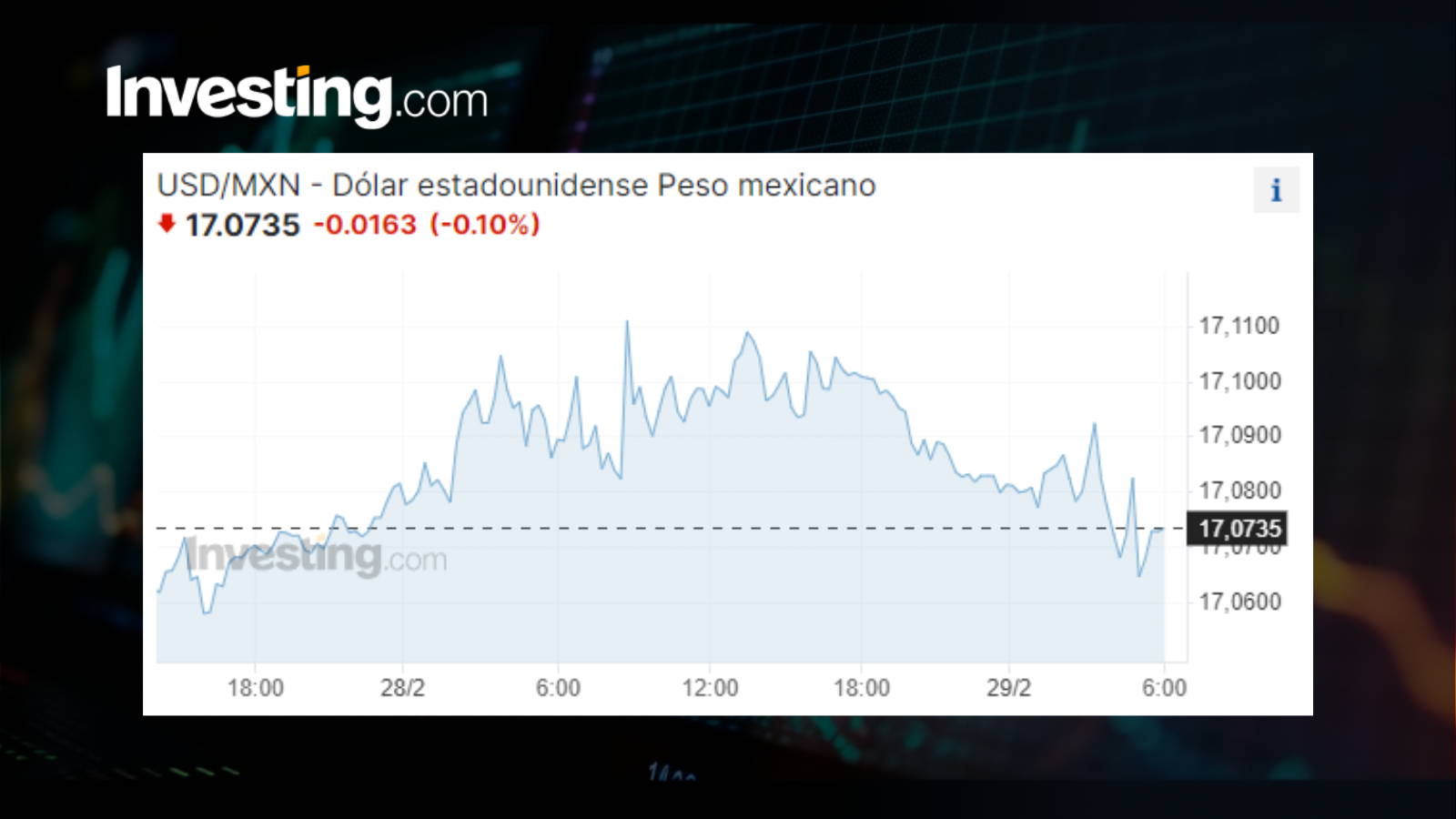

According to real-time data from Investing.com, at around 06:00, Mexico City time, the exchange rate of the dollar to the Mexican peso was located at 17.07 units, with the local currency gaining 0.1%.

Thus, the local currency advanced after ending the previous day with a depreciation of 0.18%, following the release of data that showed the world’s largest economy may have grown less than expected in the fourth quarter.

“Risk aversion spread among operators after learning the new reading of United States GDP for the final quarter of 2023. This is because the new consumption data supports the Fed’s stance on keeping interest rates high for a longer period of time. ” commented Jorge Gordillo Arias, director of . Economic and stock market analysis at CIBanco.

At the same time, the currency, which measures its growth against a basket of six other major currencies, saw a marginal decline of 0.07%, reaching 103.90 units.

This Thursday, investors will pay attention to a series of key data in the United States, highlighted by the personal consumption price index (PCE index) for January, the Fed’s preferred measure of inflation.

“The market estimates this will see a 2.4% annualized recession, so a reading above that level will fuel speculation that the Fed will wait longer to start cutting interest rates, which will put pressure on the peso’s exchange rate, ”explained Gabriela Siller Pagaza, director of economic and financial analysis at Grupo Financiero Base.

Similarly, data on people registered last week will be released, with economists estimating an increase of 8,000 applications for this assistance compared to previous data, bringing the total to about 209,000 requests.

The figure, which is expected to record 1,874 million, would mean an increase of 12,000 requests compared to last week’s 1,862 million.

In local statistics, January figures were released this morning. The National Institute of Statistics and Geography (INEGI) reported that in the first month of 2024, the unemployed population stood at 1.7 million, giving an unemployment rate of 2.9%. This reflects an increase of 2.6% seen last month and better than the 2.8% expected by consensus.

If the exchange rate closes the session at its current level, the Mexican peso will end February with a monthly appreciation of 0.8%, thus returning to profit territory after the 1.5% monthly depreciation seen in January.

Do you know that you can also invest in the stock market? Play wisely and get the best returns on the market? You can achieve this with InvestingPro, We will give the readers of this article InvestingPro with additional discounts When using discount code titanspro1 When you subscribe to our 1 or 2 year Pro or Pro+ plan, Click here and apply your promotion now!