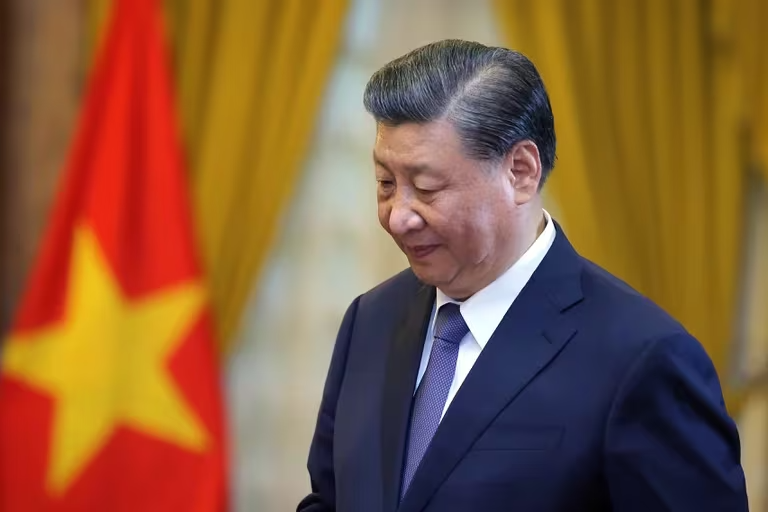

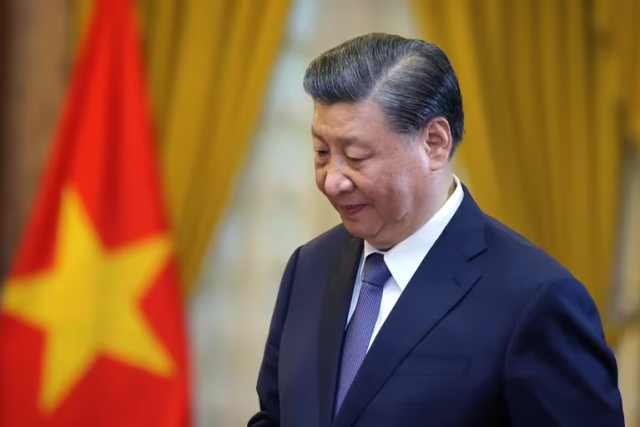

This year, investors in Chinese stocks have had a hair-raising journey. While the US S&P 500 index reached an all-time high, Chinese and Hong Kong markets lost $1.5 trillion in January alone. Retail investors have taken to Chinese social media to express their disappointment. The collapse was so brutal that Chinese President Xi Jinping was informed on February 6, and Yi Huiman, the head of China’s securities regulator, was fired the next day. There was some improvement in prices when government-owned companies started buying shares. These may increase further in the coming days.

However, if we take a step back there is no doubt that the overall picture is bleak. The market value of Chinese and Hong Kong stocks has dropped nearly $7 trillion from its peak in 2021, a decline of nearly 35%, while the value of US stocks has risen 14% and India’s have risen 60%. This decline points to a fundamental problem. Domestic and foreign investors viewed the Chinese government as a reliable manager of the economy. Now this confidence has been eroded, which will have serious consequences for China’s development.

Less than a decade ago, Chinese markets were euphoric. Foreign investors were eager to tap the potential of the rising global economic star. China was growing at a steady and impressive rate of over 6% annually. Foreign portfolio investment increased when foreign investors gained direct access to Chinese stocks through Hong Kong in 2014. Four years later, financial firm MSCI began including mainland Chinese stocks in its global indices. The Chinese government, for its part, hoped to attract foreign capital and expertise to professionalize its markets and create an asset class to replace real estate. A group of wealthy businessmen and investors was emerging, whom Xi himself urged to live the Chinese dream.

The underlying understanding was that, regardless of Chinese policy, its officials could be trusted to lead the economy to prosperity. China will continue to grow at a rapid pace, its citizens will continue to value wealth and economic stability before political freedom, and foreign investors will reap huge profits. Everyone can become rich.

What’s wrong? One of the most famous problems is Xi’s lax policy. The tightening of technology regulations that began in 2020 weakened investor confidence. The exit from shed zero was a failure. The government has faltered in the face of a housing crisis that has weakened savings and confidence and pushed the economy into deflation, with prices falling in January at the fastest pace since the 2007-2009 financial crisis. It’s no wonder you want to prevent the bubble from re-inflating. But he wants to avoid concessions and focus development on “high-quality” sectors that he believes will help China counter the technological, economic and military strength of the United States. However, profits in these sectors also fell last year. And China lacks the stimulus it needs.

In more detail infobae