Investing.com – During March, the Mexican peso has once again surprised with its strength against the US dollar, with the exchange rate several times reaching the lowest level not seen since mid-2023, the national currency’s It is a year of historical appreciation.

So far this month, the Mexican peso has already appreciated by 1.67%, extending the gain seen in the entire month of February to 0.95%. According to real-time data from Investing.com, the exchange rate has averaged 16.80, significantly higher than the average of 17.07 during February.

The local currency’s gains have been driven by weakening expectations of the start of a Federal Reserve (Fed) cut cycle in June as speculative positions in the futures market continue to bet on the peso’s appreciation.

In addition, it has managed to resist the rate cut announced by the Bank of Mexico (Banxico) last Thursday, which means a reduction in the rate differential with the United States as expectations remain that the monetary authorities will maintain restrictive policy throughout. Will maintain. Year. It is worth remembering that this gap has been one of the factors that has catalyzed the peso’s rise against the dollar.

Due to this, at the end of the first quarter of the year, Citibanmex analysts have adjusted their projections on the exchange market, recognizing the improved position of the Mexican peso against its American pair, although still trending towards the depreciation of the local. hopefully. Currency, but very much moderate.

Thus, he now estimates that at the end of 2024, the exchange rate will be 17.83 pesos per dollar, whereas previously he saw it at 18.58. They have also made an adjustment for the end of 2025 and now predict parity at 18.79 units whereas their previous forecast had them expecting 19.58.

“Given the recent behavior of the exchange rate, we have adjusted our estimates downwards, but we expect a gradual upward trend,” he said.

One of the factors that could curb the Mexican peso’s gains against the US dollar is the narrowing of the interest rate differential following the cut by the Banco.

“We can expect a less volatile environment for the exchange rate as the central banks’ provisions for 2024 become known, a scenario of greater flexibility may be justified as we enter the year. For now, we expect the exchange to continue trading above 16.60 pesos per dollar, taking into account the context of the world’s leading economy,” said Renato Campos, senior analyst at Hantec Markets.

In the most recent edition of the Citibanamex Expectations Survey, the analysts’ consensus has also revised their expectations, leaning towards a stronger peso than previously expected.

Thus, the exchange rate is now unanimously projected to be 18.20 pesos per dollar by the end of 2024, up from 18.50 recorded in the previous survey. For the end of 2025, the average expectation dropped to 19.00 pesos per dollar from 19.15 in the previous forecast.

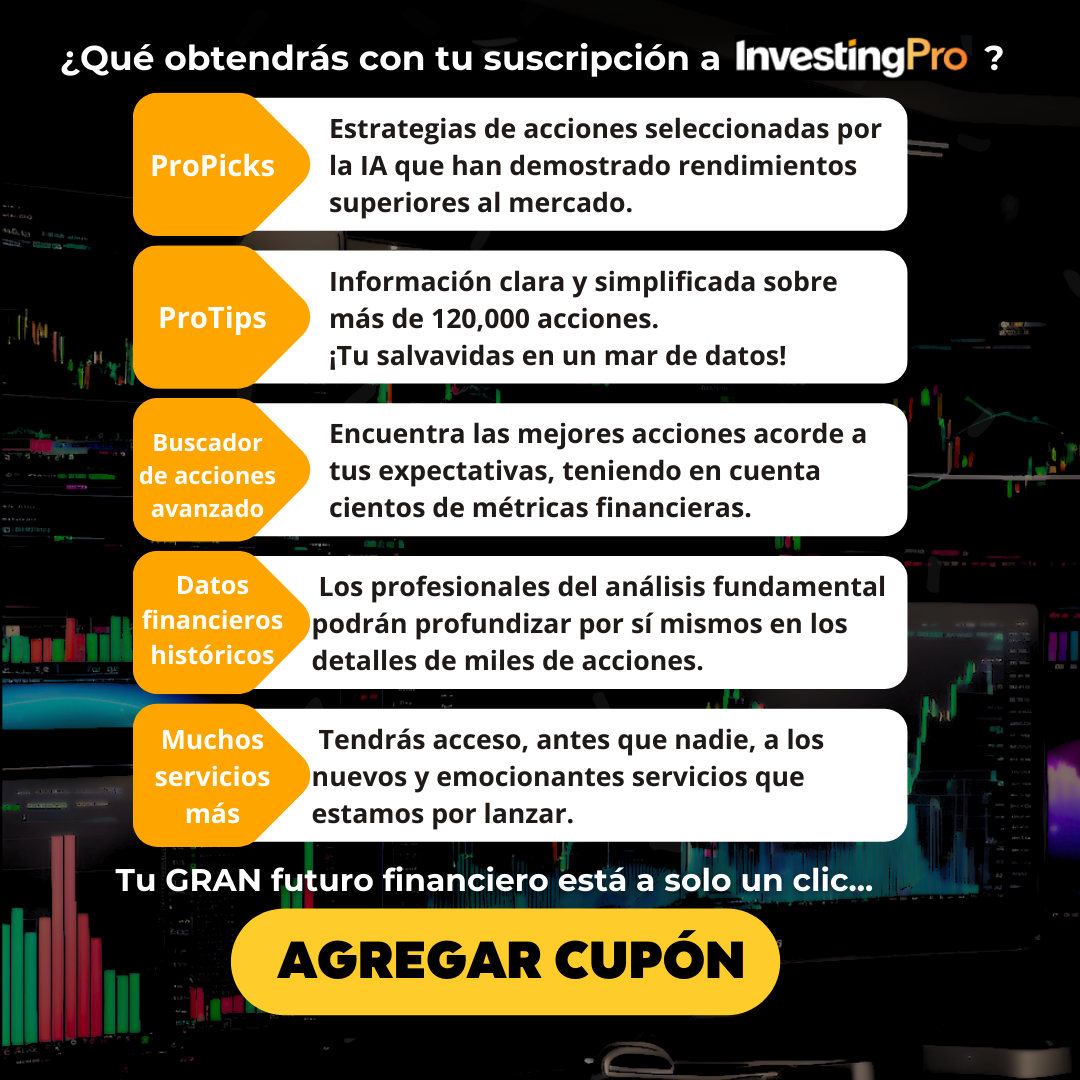

It is noteworthy that at present the Mexican peso remains strong and at its best level of the year. This is a unique opportunity for Mexican investors to gain access to InvestingPro’s powerful tools at the best price ever.Which will allow them to strategically prepare their portfolios to get the best returns in the stock market and ride the wave of profits that will come when interest rates start falling. Access InvestingPro here!