Consumers pay four taxes on every gallon of gasoline or diesel they buy and that money is collected by the Treasury to allocate toward certain subsidies.

Due to at least three taxes applied to every gallon of fuel consumers purchase, the government collected $151.9 million in 2023.

Of these taxes, there are two in particular that generated the most revenue last year, even with increases of over 100%, and have helped shore up the state’s purse strings.

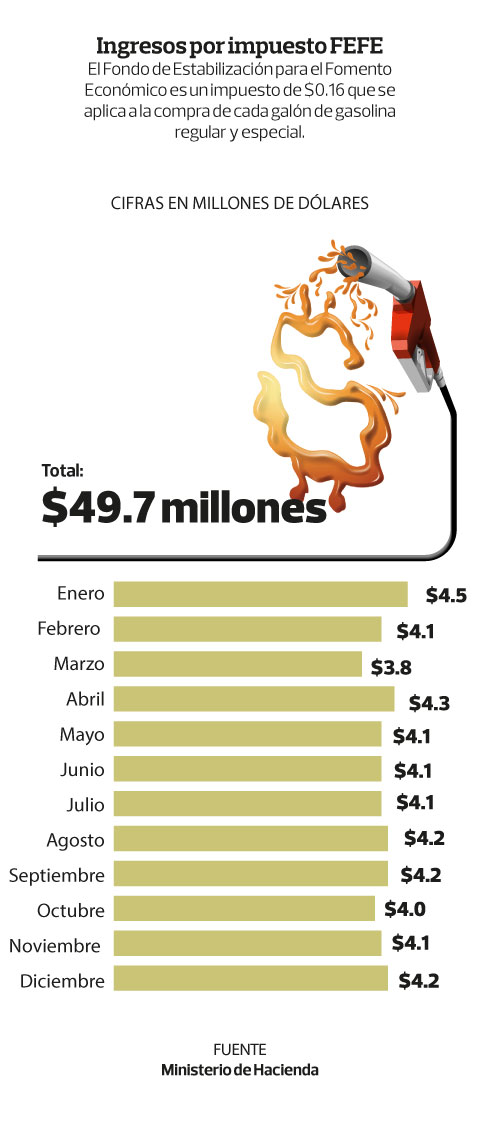

For example, from January to December 2023 treasure $49.7 million was received from the FEFE tax (Stabilization Fund for Economic Development), known as the “war tax”, which has been collected since 1981.

If compared to the same period in 2022, the data indicates that collections have more than doubled, as there was an additional $27.5 million in income. According to data from the December 2023 income report on the fiscal transparency portal of the tax authorities, the amount collected last year was $22.2 million, i.e., there was an increase of 123.8% in the collection of this fuel tax compared to the previous year.

You can read. Nuevas Ideas calls for expanding the law that bans violations in fuel sales

This tax applies at $0.16 per gallon petrol Regular and special.

Average monthly revenue from FEFE was over $4 million, with January being the best month in collections and March being the lowest month of the year.

This income from the “war tax” was supposed to be used to pay for the subsidy of propane gas for domestic use.

In 2023, the government had allocated $85.7 million in the annual budget for gas subsidies, but for this year it increased that amount to $116.3 million, an additional $30.6 million in that sector.

However, compared to what was collected through FEFE, what it planned to allocate for the said subsidy would be short by at least $36 million.

Another fuel tax from which the government received funds was for a “special contribution to public transport”, known as COTRANS (Economic Compensation for the Public Service of Mass Passenger Transport and Stabilization of Rates). The purpose of these funds is to subsidize bus and minibus drivers so that they do not increase the fares paid by users.

It collected $55.3 million in taxes in the 12 months last year, compared with $25.2 million in the same period in 2022, according to the Treasury income report.

This means the increase was $30 million, representing an increase of 119% from one year to the next.

Monthly revenues were between $4.3 million and $5.1 million, with January being the month with the highest collections.

It is a tax of $0.10 on every gallon of fuel purchased by citizens and has been in place since 2007. Although the decree supporting this fee expired on June 30, 2020, Salvadorans currently continue to pay that contribution on each gallon of hydrocarbons. ,

In fact, last April, due to a legislative error, the collection of said tax was suspended until July 29, 2023, at least on paper, as in practice it continued to be collected from consumers month after month.

Foveal’s earnings are no longer public

In addition to contributions to FEFE and public transportation, Salvadorans also contribute funds through another tax imposed on each gallon of fuel purchased at gas stations in the country.

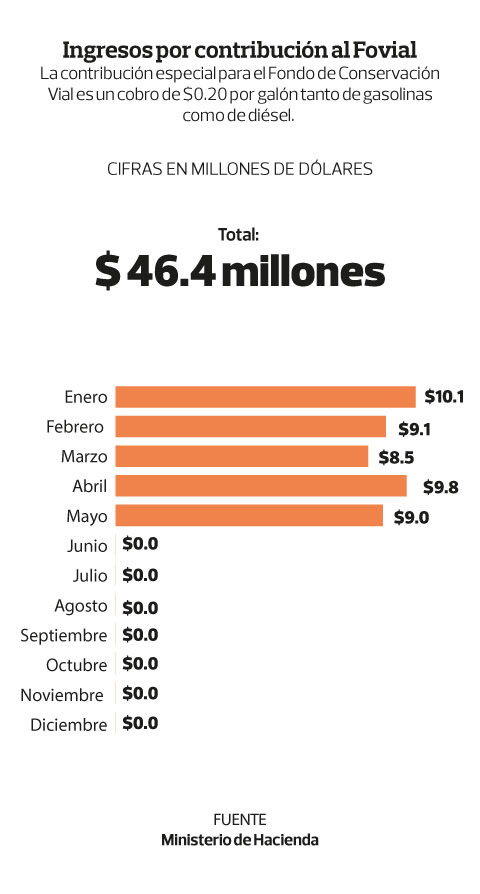

It is also classified as a “special contribution” within the income received by the Treasury and is the highest, as it is $0.20 for each gallon of gasoline.

According to a Treasury report with data up to 31 December, the income collected goes to the Road Conservation Fund (FOVIAL) and was $46.4 million in 2023.

According to these figures, it collected $61.6 million less than in 2022, which means there will be a 57% decline in collections.

But according to the records disclosed, Foveal’s income from last June was not reported on the Treasury Transparency Portal, so the $46.4 million actually corresponds to just five months (January to May).

On average, $9 million was collected monthly, so if income was the same in the following months, at least $45 million more would have been collected (from June to December). However the Treasury had budgeted for last year that it would raise $104.7 million from the said contribution.

Whereas in 2022, a total of $108 million was collected from the tax received by Foveal.

However, the actual amount that went into the hands of the institution responsible for the repair and maintenance of roads is unknown, since the reform of Article 26, paragraph 4 of the Foveal Law was approved by the Legislative Assembly on April 26, 2023. and published in the Official Gazette on 12 May, the income from special contributions was no longer allowed to enter the general treasury of the state, nor was the treasury permitted to disclose it.

The approved and currently in force provision establishes that funds must be deposited into a bank account that Fovial has designated for this purpose, but limits on how many resources it manages and what they are used for. Details are not known.

And other money that the government has collected and which is classified under a “selective consumption tax” is “ad-valorem” on fuel and which according to the Treasury reports was $500,000 in 2023: $400,000 received in April and then Another $100,000 was received in May. ,

However, according to official records, this tax did not generate any income in 2022.

But there is no doubt that a significant contribution to the wealth generated from fuel purchases by citizens is the payment of 13% VAT on each gallon of gasoline or diesel. However, it is not mentioned in the treasury report how much VAT money comes from that item.

And the more expensive a gallon of fuel is, the more money will come into the state’s coffers.

In fact, premium gasoline rose $0.11 in three areas of the country over the past fortnight, taking its price from $3.88 to $3.92 a gallon; The regular increased by $0.04 and $0.05, so its price is between $3.71 and $3.76; Diesel also rose $0.04 and is priced between $3.73 and $3.74 per gallon.

This was the first price hike announced at the beginning of the year, with prices valid until January 22, when the Directorate General of Energy, Hydrocarbons and Mines announces new costs for the next 15 days.

However, 2023 closed with several consecutive declines in hydrocarbon prices in recent months, falling above $1.00 per gallon of gasoline.