The US economy fared better than expectations in 2023. The widely anticipated recession never came. Many economists (though not me) argued that reducing inflation would require years of high unemployment; Instead, we have experienced pure deflation, inflation that falls rapidly with no direct costs.

Paul Krugman || the new York Times

But in the world’s largest economy (or second largest, depending on the measurement) the story has been very different. Some analysts had expected China’s economy to grow after lifting the stringent “zero Covid” measures adopted to contain the pandemic. In contrast, China has performed poorly in almost every economic indicator except official GDP, which reportedly grew by 5.2 percent.

But there is widespread doubt about that figure. Democratic nations like the United States rarely politicize their economic data (though ask me again if Donald Trump returns to power), but authoritarian regimes often do.

In other respects, China’s economy seems to be faltering. Even official figures say China is experiencing Japanese-style deflation and high youth unemployment. This is not a full-blown crisis, at least not yet, but there is reason to believe that China is entering an era of stagnation and despair.

Why is China’s economy, which seemed poised to dominate the world just a few years ago, in crisis?

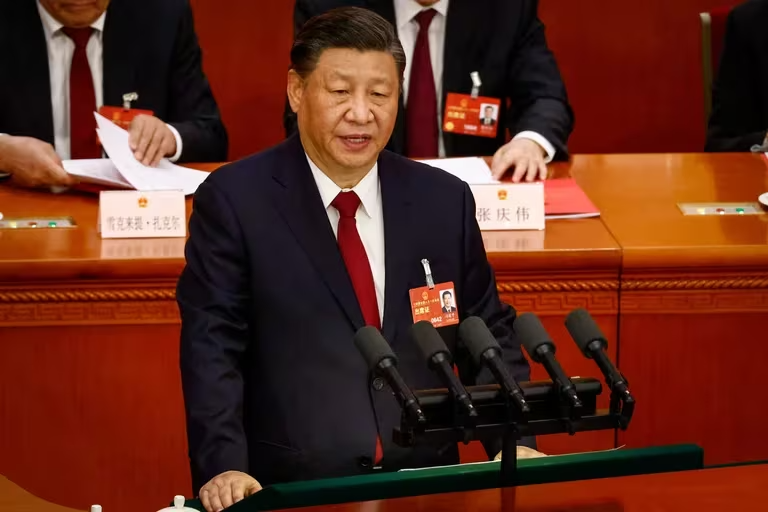

Part of the answer is poor leadership. President Xi Jinping is beginning to look like a poor economic manager whose tendency to intervene arbitrarily (something autocrats do) has stifled private initiative.

But even if Xi had been a better leader than him, China would have been in trouble.

It has long been clear that China’s economic model was becoming unsustainable. As Stewart Patterson points out, consumer spending as a percentage of GDP is very low, probably for several reasons. These include financial repression (paying low interest on savings and providing cheap loans to favored borrowers) that keeps household incomes low and diverts them into government-controlled investments, a weak social safety net that leaves households vulnerable to potential emergencies, and To cope, accumulate savings, and much more.

With consumers buying so little, at least relative to the productive capacity of the Chinese economy, how can the country generate enough demand to keep that capacity in use? The primary response, as Michael Pettis points out, is to promote extremely high investment rates, more than 40 percent of GDP. The problem is that it is difficult to invest that much money without facing very low returns.

In more detail the new York Times