© Reuters.

Investing.com – It is fighting to continue its winning streak against the US dollar, although the battle is becoming increasingly difficult. At the beginning of the session this Tuesday, March 12, the price of the dollar tried to remain below 16.80 units, while investors digested inflation data in the United States in line with February, which was slightly above economists’ expectations. This may cast doubt on the possibility that the Federal Reserve (Fed) may soon start cutting interest rates.

At around 06:40, Mexico City time, the exchange rate from the dollar to the Mexican peso, reached 16.77 units, with the local currency seeing a slight increase of 0.03% after the announcement of the inflation data. However, the local currency was not able to sustain itself at these levels and the exchange rate subsequently bounced back and reached above 16.80 units once again.

At the same time, the currency, which measures its growth against a basket of six other major currencies, saw a decline of 0.13% to 102.74 units.

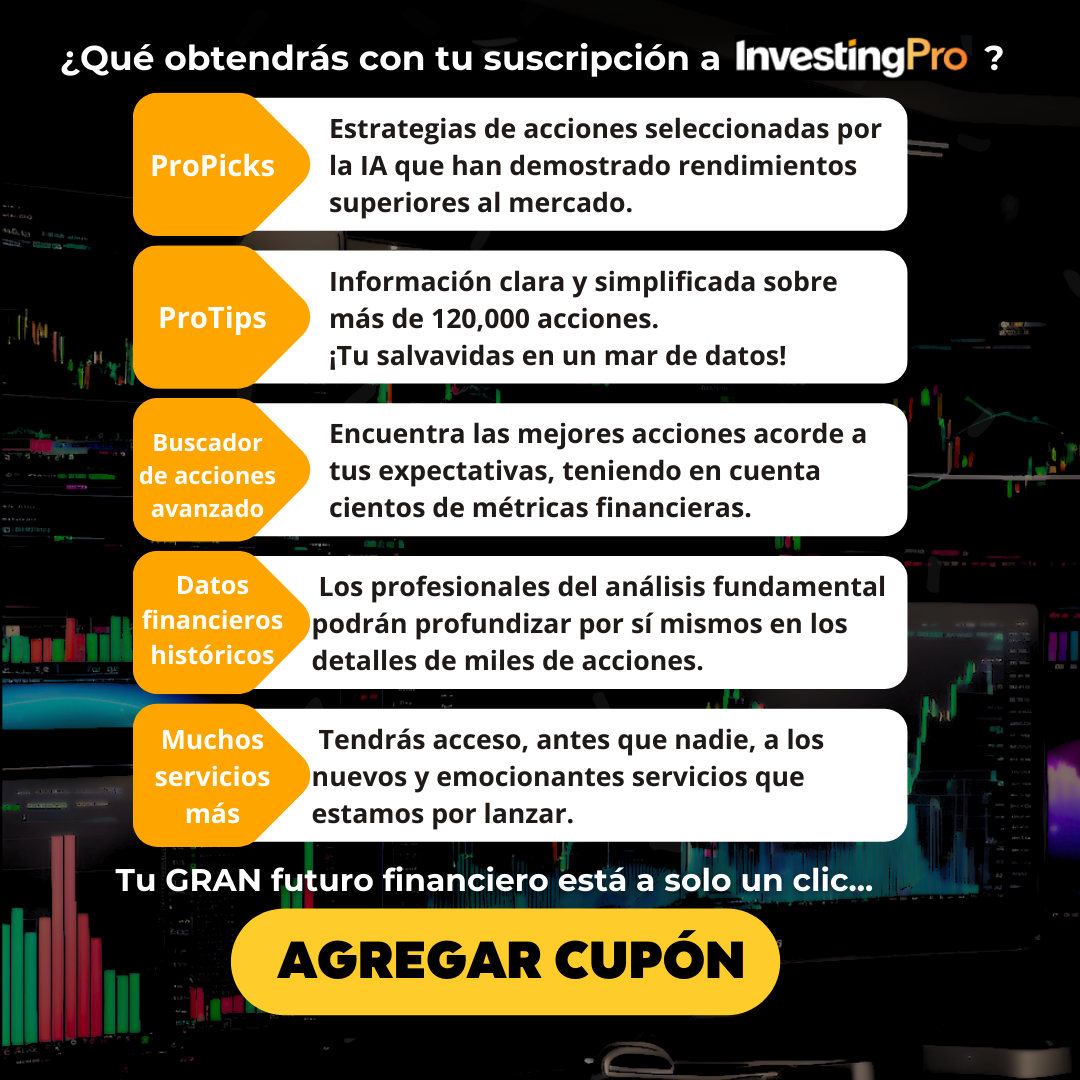

Investors are paying close attention to the onset of interest rate cuts to strategically configure their portfolios. And To achieve maximum profitability, Hundreds of investors in Mexico and thousands of investors around the world trust InvestingProWhere they get all the information, data and analysis that has allowed them to ride the wave of profits in the stock market. Are you already one of them? Become a pro here!

This morning it was announced that general inflation in the United States surprised economists by hitting an annual rate of 3.2% in February, while a rate of 3.1% was expected. This also marks an increase from the 3.1% seen in January.

“There was a modest pickup in inflation today, which keeps Fed members cautious about the next adjustment of its monetary policy and reinforces the restrictive approach that Jerome Powell commented on in his testimony before Congress last week.” Janeth Queiroz Zamora, director of economic, exchange and stock market analysis at Grupo Financiero Monex.

The underlying indicator, which allows to determine the inflation trajectory in the medium and long term, saw a deceleration in its annual reading, which stood at 3.8%, down from 3.9% registered in January. Still, the result was above the consensus-expected 3.7%.

“Most of the work has already been done. Inflation in the United States has risen from near double digits, the highest in four decades and unbecoming of a developed economy, to about 3%, only one-tenth of the 2% objective. According to the last mile analogy, in economic terms, this stretch is the most difficult and therefore requires an additional sacrifice in terms of growth and employment,” explained Jorge Gordillo Arias, director of economic and stock market analysis at CIBanco.

In its monthly reading, headline inflation rose to 0.4% in February, from 0.3% in January, but in line with estimates. The underlying also recorded a reading of 0.4%, the same level as previous data but above the expected 0.3%.

“In the most recent phase, this is the final phase, monetary policy should focus on a sustained reduction in underlying inflation. “Considering that the last mile is more exhausting could cause the Fed to tighten policy more than necessary, increasing the likelihood of a recession and a sharp rise in unemployment,” the expert said.

,

You are lucky today! We will give the readers of this article InvestingPro with additional discounts. Just use discount code super pro When you subscribe to our 1 or 2 year Pro or Pro+ plan, Click here and apply your promotion now!

Play Crazy Game Trusted Gaming News Portal

Play Crazy Game Trusted Gaming News Portal

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/J44ABCPIXRA6TAE3MH45PRTLJ4.jpg)

:quality(70)/static.themebuilder.aws.arc.pub/elimparcial-sandbox/1706745207765.png)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/F4CY45ZTUZCBBL5UE53K6F4NEI.jpg)