Investing.com – At the beginning of the session this Wednesday, March 20, there was a decline against the US dollar, the exchange rate remained above 16.80 units, while investors are waiting for the great event of today’s session: the monetary policy announcement. United States Federal Reserve.

At around 06:00, Mexico City time, the exchange rate, from the dollar to the Mexican peso, was located at 16.83 units, which meant that the local currency had seen a decline of 0.21%. In this way, according to real-time data from Investing.com, the Mexican peso reversed part of the gains made at the end of the previous session, in which it gained 0.14%.

The decline of the Mexican peso parallels the strength recorded this morning, which measures the currency’s development against a basket of six other main currencies, as it gained 0.5%, reaching 104.11 units.

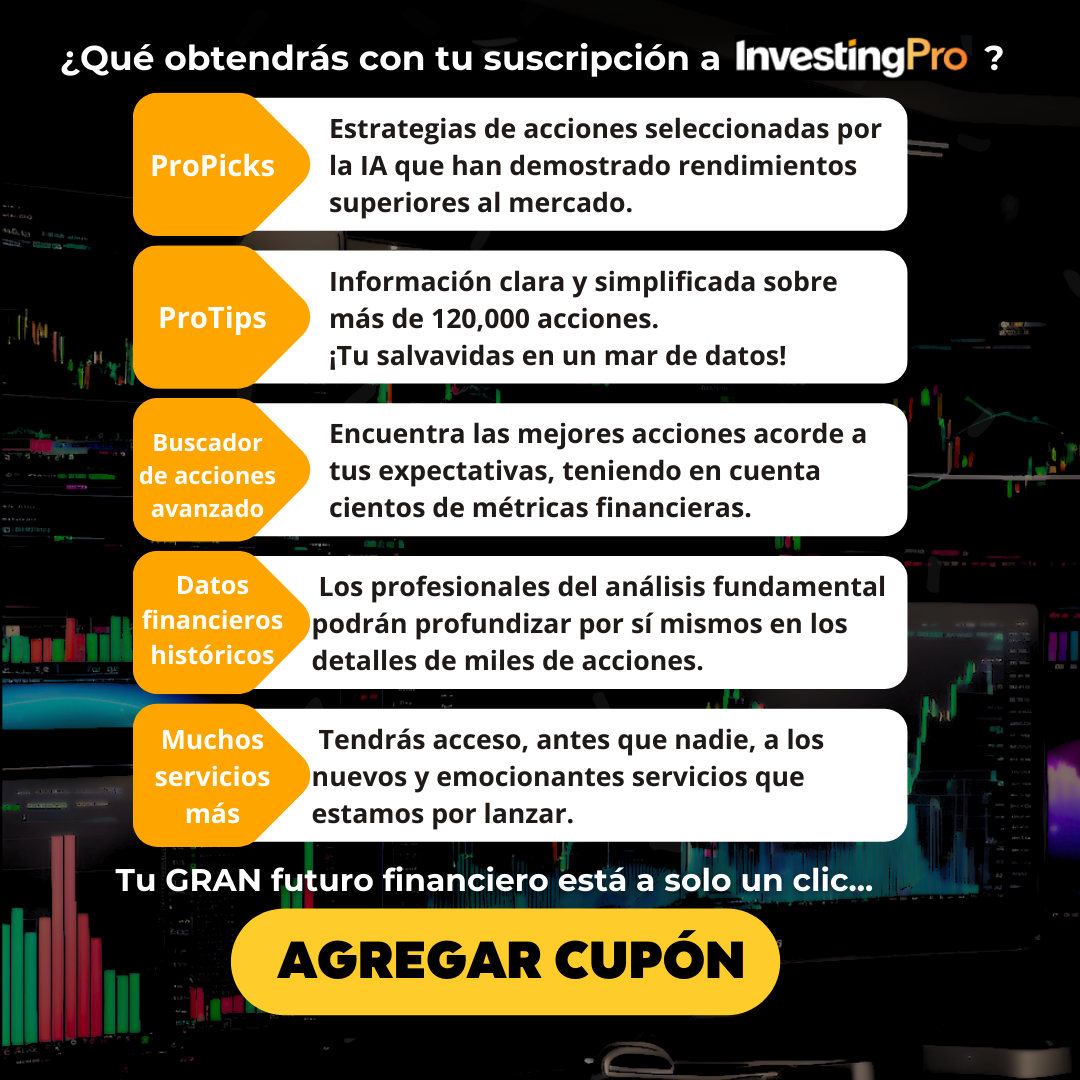

Nevertheless, the Mexican peso remains strong and at its best level of the year. This is a unique opportunity for Mexican investors to gain access to InvestingPro’s powerful tools at the best price ever.Which will allow them to strategically prepare their portfolios to get the best returns in the stock market and ride the wave of profits that will come when interest rates start falling. Access InvestingPro here!

This Wednesday, the markets are awaiting the announcement from the Fed’s Federal Open Market Committee (FOMC), which will be announced at noon in Mexico City. The expectation is that monetary authorities will leave rates unchanged in the current range of 5.25 to 5.50%.

According to Investing.com’s Fed Rate Barometer, the market is currently betting that the central bank will make the first interest rate cut at its June meeting with a 60% probability.

But the focus will be on updating economic forecasts as well as updating dot plots dot plot, which reflects the view of each of the FOMC participants on the most appropriate path for interest rates over the coming years and longer term. Some analysts have raised the possibility that the rate cut forecast for 2024 at this meeting will be reduced from 75 basis points (bp) shown in the previous diagram to 50 bp, which would indicate only two cuts this year.

“While no change in the reference rate is expected, the focus will be on economic forecasts, and if these continue to favor a scenario of three rate cuts a year. Similarly, the words of the US central bank chairman will be relevant to the extent that they reflect whether the deflation process is moving forward or has lost a little strength over the past month,” commented Jorge Gordillo Arias, director of Economics & Stock. . Market Analysis at CIBanco.

This afternoon’s announcement will also be a prelude to the Bank of Mexico (Banxico) next Thursday, which is expected to cut interest rates by 25 basis points (bp).

If this movement had occurred, the Mexican central bank would have been ahead of the Fed in lowering rates, but markets have absorbed the broad possibility that this first decline will not be the beginning of an upward cycle, but rather an adjustment, and that Banxico will maintain interest rates at restrictive levels throughout the year.

“Stability in inflation expectations, rate adjustments in other emerging markets and the strength of the Mexican peso will help justify (rate) cuts. However, the balance of price risks that is still tilted to the upside and the Fed with little room for maneuver will limit more rhetoric. dovish“, said group strategists Banort Financial (BMV:).

If you subscribe today InvestingPro You will be able to get a complete picture about the activities in the stock market and estimate your strategy towards cutting interest rates. As an investor and member of the Pro community you will have access to key metrics such as fair value, outlook for each stock based on specific algorithms. protipsAnd the most complete analysis tools that will allow you to analyze, compare and make an intelligent investment decision.

Play Crazy Game Trusted Gaming News Portal

Play Crazy Game Trusted Gaming News Portal

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/J44ABCPIXRA6TAE3MH45PRTLJ4.jpg)

:quality(70)/static.themebuilder.aws.arc.pub/elimparcial-sandbox/1706745207765.png)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/F4CY45ZTUZCBBL5UE53K6F4NEI.jpg)