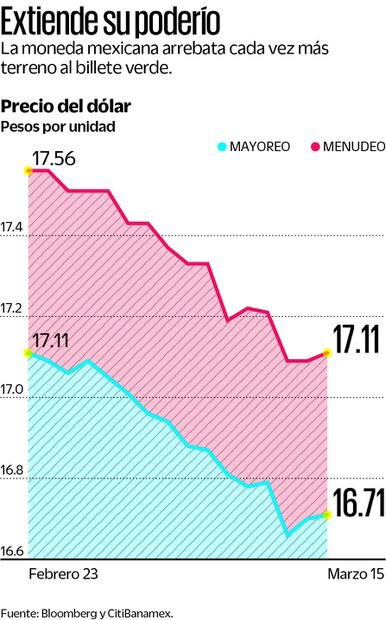

The national currency ended at 16.71 units per dollar yesterday, up 0.6% or nine cents from last Friday.

Wholesale operations reported by Bloomberg indicate that this is the third consecutive week that the dollar has gained.

The Mexican currency fell second to the Chilean peso this week, rising 2%.

Source: Bloomberg and Citibankmex

The appreciation is due to market confidence that the Bank of Mexico (Banexico) will cut its key interest rate to 11% from 11.25% next Thursday, without heralding more cuts.

Superweights also benefit from speculative positions, as they have been in their favor for 53 consecutive weeks on the Chicago futures market, said Janeth Queiroz, director of economic, exchange and stock market analysis at Monex.

“The net position remained close to a maximum not seen since March 2020,” he highlighted.

The national currency appears to be the most valuable since the beginning of 2024 when considering the broader basket of main crosses, due to the fact that it has accumulated an advance of 1.4% or 24 cents.

At retail, the dollar sold for 17.11 pesos on Citibankmex counters on Friday, eight cents lower than last week’s close.

The performance of the exchange market will be determined by next week’s monetary policy decisions. Notably, the United States Federal Reserve will announce this on Wednesday and the Bank of Mexico will do the same on Thursday.

The results for stock markets in the United States were negative, with the Dow Jones falling marginally by 0.02% compared to last Friday and suffering a three-week loss for the first time since October last year. For its part, the Nasdaq Composite fell 0.7%, while the S&P 500 fell 0.1%.

On the other hand, the Mexican Stock Exchange’s main indicator ended up 2.4% compared to last Friday, ending a five-week streak in the red.

Inside, mining and infrastructure group Grupo Mexico was the best performer with a 15.1% rise on the back of higher international copper prices, followed by restaurant operator Alcee, whose stock set a growth target to exceed its earnings. After increased by 10.7%. 10% in 2024.

In the crude market, a barrel of oil extracted from Texas, known as WTI and reference for Mexican blending, finished at $81, a weekly increase of 3.9% due to the United States Energy Information Administration’s report. Which shows that oil reserves fell by 1.5 million barrels last week.

(tagstotranslate)superpeso

Play Crazy Game Trusted Gaming News Portal

Play Crazy Game Trusted Gaming News Portal

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/J44ABCPIXRA6TAE3MH45PRTLJ4.jpg)

:quality(70)/static.themebuilder.aws.arc.pub/elimparcial-sandbox/1706745207765.png)

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/F4CY45ZTUZCBBL5UE53K6F4NEI.jpg)